Top Notch Tips About How To Claim Homestead In Texas

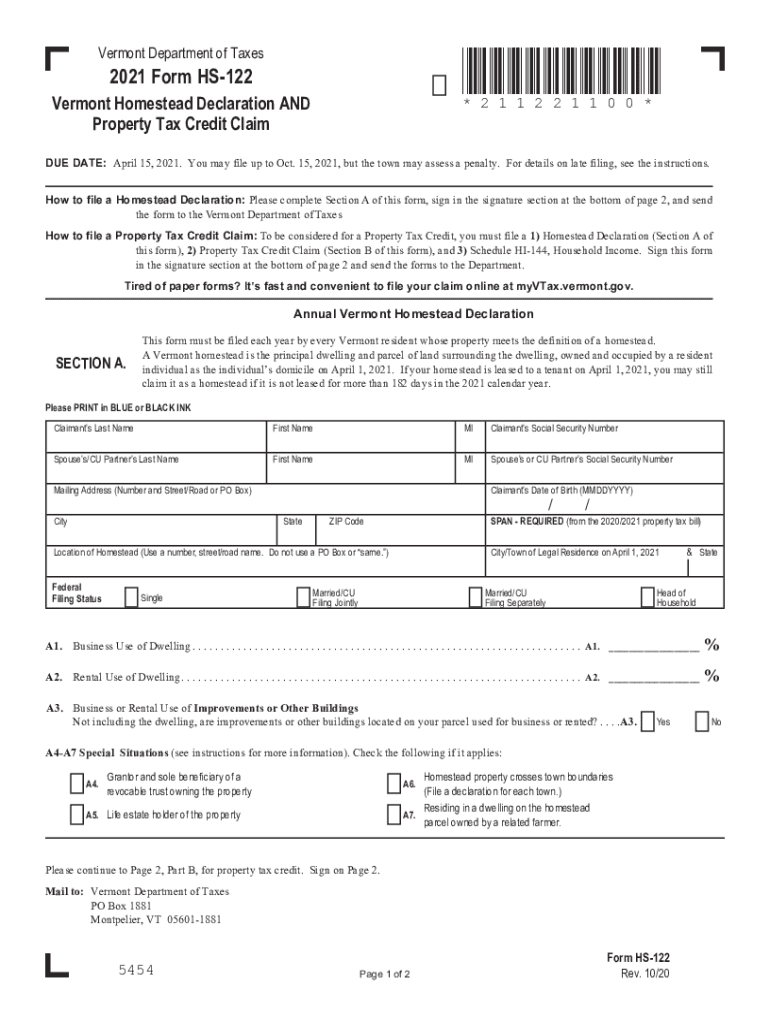

You can find forms on your.

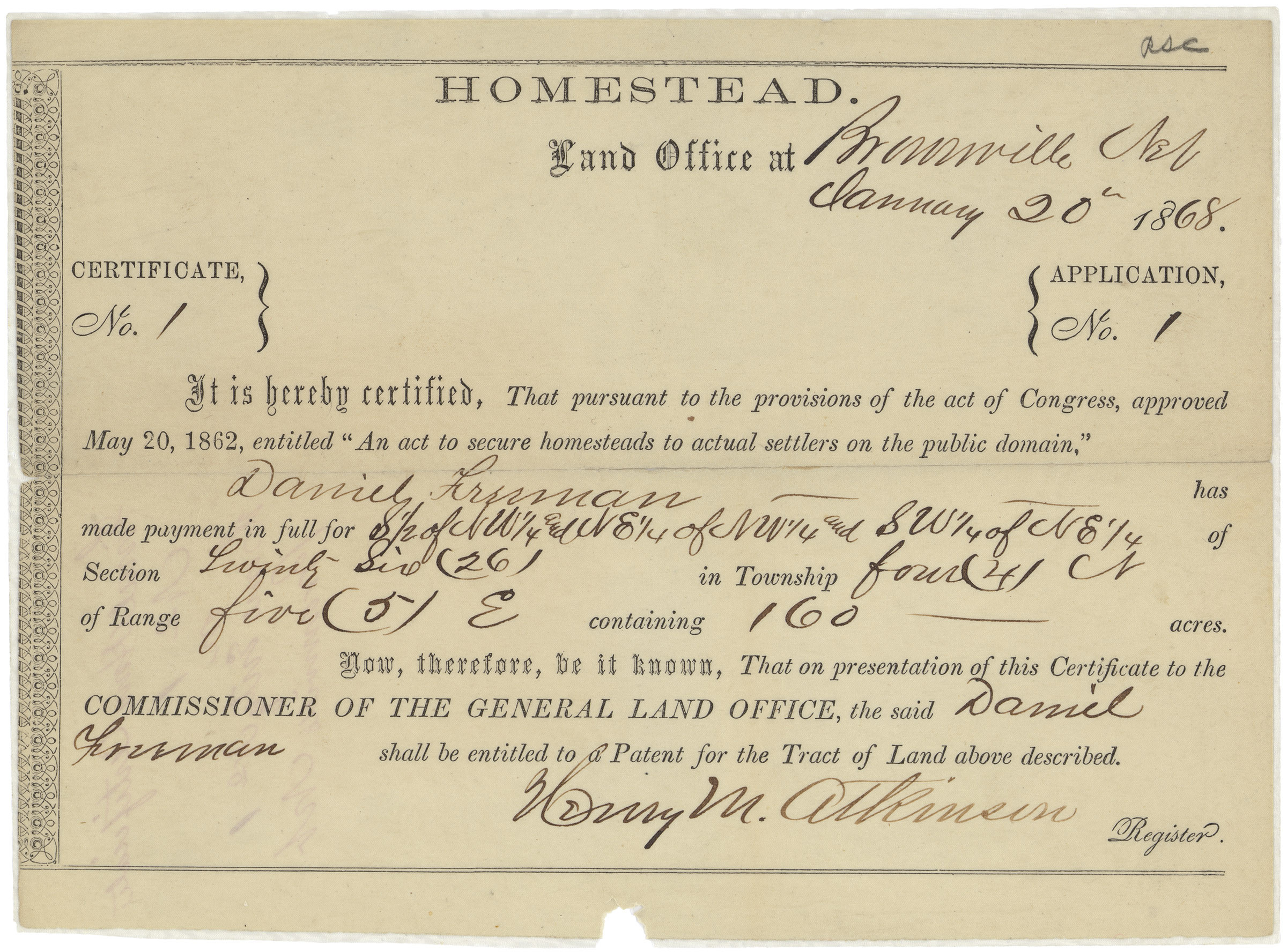

How to claim homestead in texas. The application for residence homestead exemption is required to apply for a homestead exemption. A homestead exemption can save hundreds, if not thousands of dollars (due to the price of the home). A rural homestead in texas is limited to 200.

In texas, a homeowner may qualify for one or more exemptions from property taxes. It also cannot include moveable. If i live in a home that.

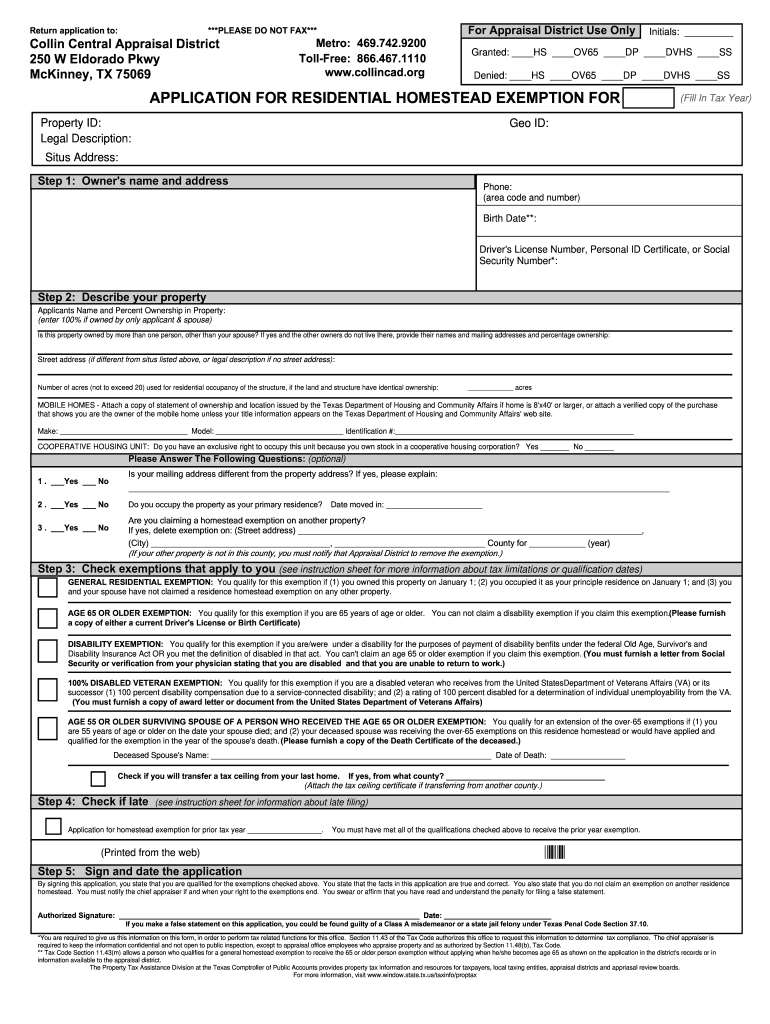

Check the box for the exemptions for which you qualify. You must apply with your county appraisal district to get a homestead exemption. How do you apply for a homestead exemption in texas?

The property should have been. A homestead cannot be more than 20 acres in texas. Its purpose is to assist in reducing the property tax payable to the.

I.e., it should be their primary residence. May i continue to receive the residence homestead exemption on my home if i move away temporarily? How much is the homestead exemption in texas?

Bought a primary residence within the past year in texas? Property owners are allowed a $40,000 exemption on their primary residence. The most significant of these is the residence homestead exemption of.

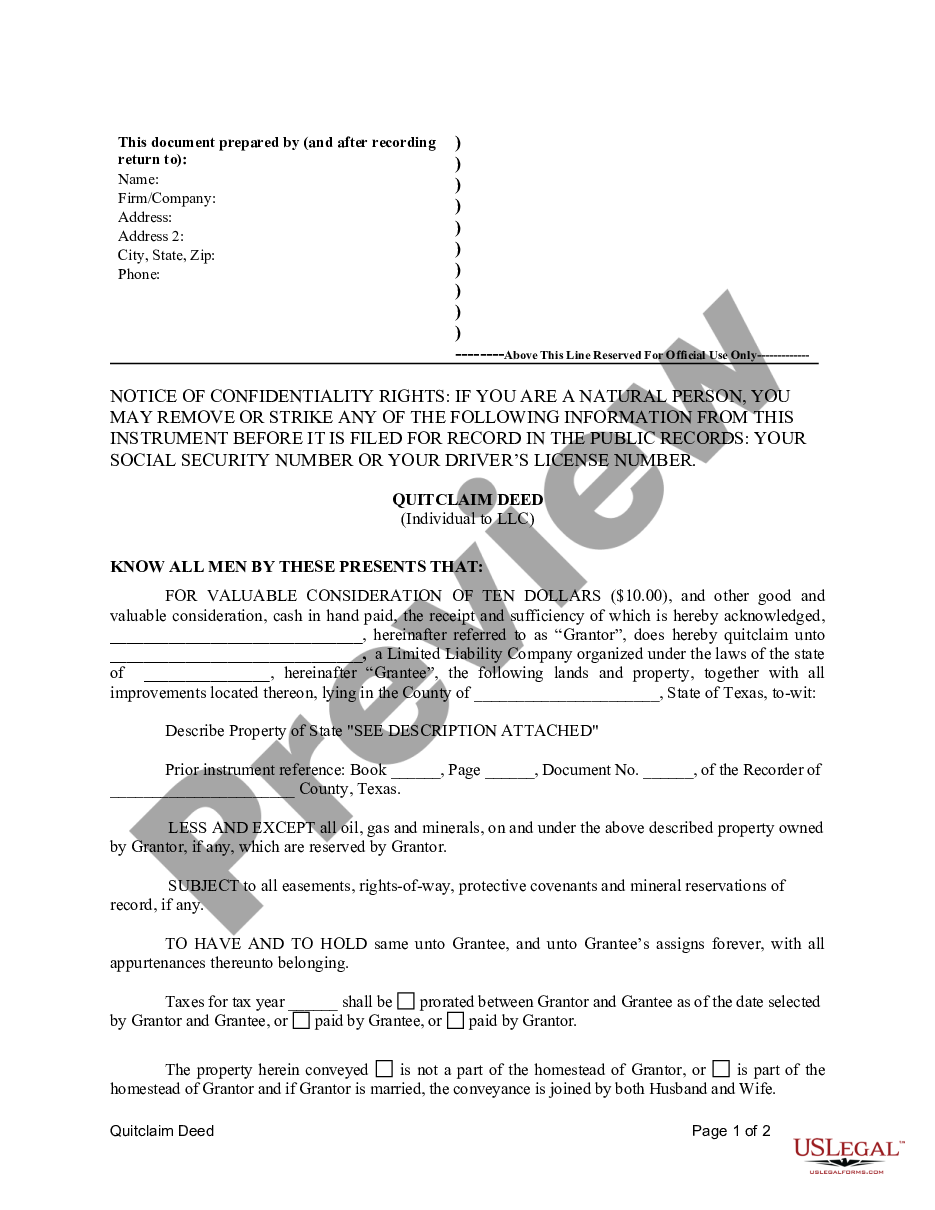

How do i get a general $40,000 residence homestead exemption? A texas homestead exemption is a tax break for homeowners who qualify. If you own multiple properties, only one can be claimed as your homestead, and it needs to be your primary place of residence.

Blogs on this page: Until 2021, the deadline for homestead exemptions used to be april 30th. Applying is free and only needs to be filed once.

Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each. For example, a $300,000 home with a $15,000 homestead exemption has a. It’s time to file for your texas homestead exemption.the state of texas allows you to claim homeste.

You must be living in the house on january 1 for the general. To claim your homestead exemption in denton county, you can mail or drop off your application form at the denton central appraisal district office at 3911 morse street,. What is a texas homestead exemption?

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/gray/UA5GCZVLXJGN3KOLYVAYCGJMW4.jpg)