Neat Info About How To Check For My Tax Return

All fields marked with an.

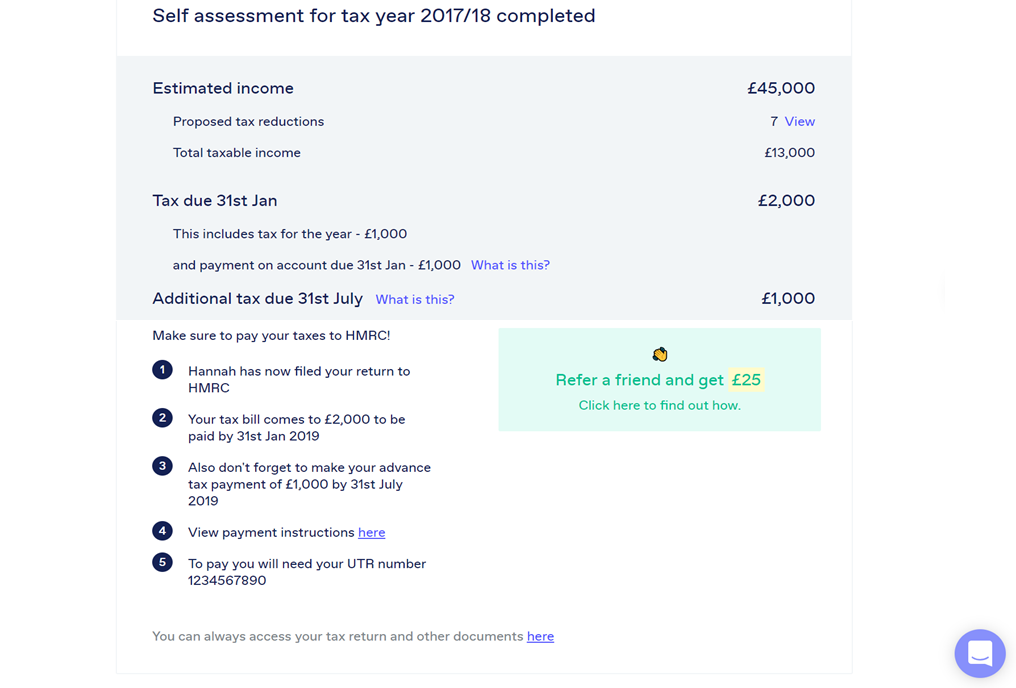

How to check for my tax return. To see if your state tax return was received, check with your state’s revenue or taxation website to find out how to confirm that your return was received. Notify us if you changed your address. The exact refund amount on your return.

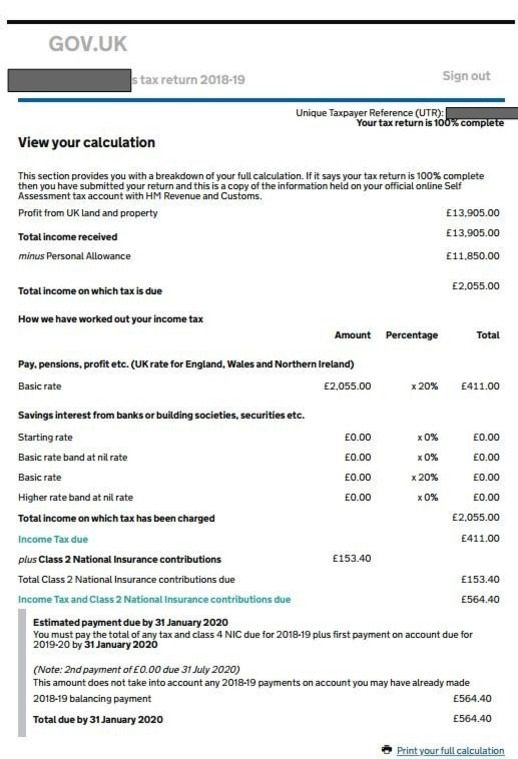

Select ato from your linked services. Check your income tax for the current year. From the home page select manage tax returns.

This service covers the current tax year (6 april 2023 to 5 april 2024). Accessibility notes for identity verification online. This is the fastest and.

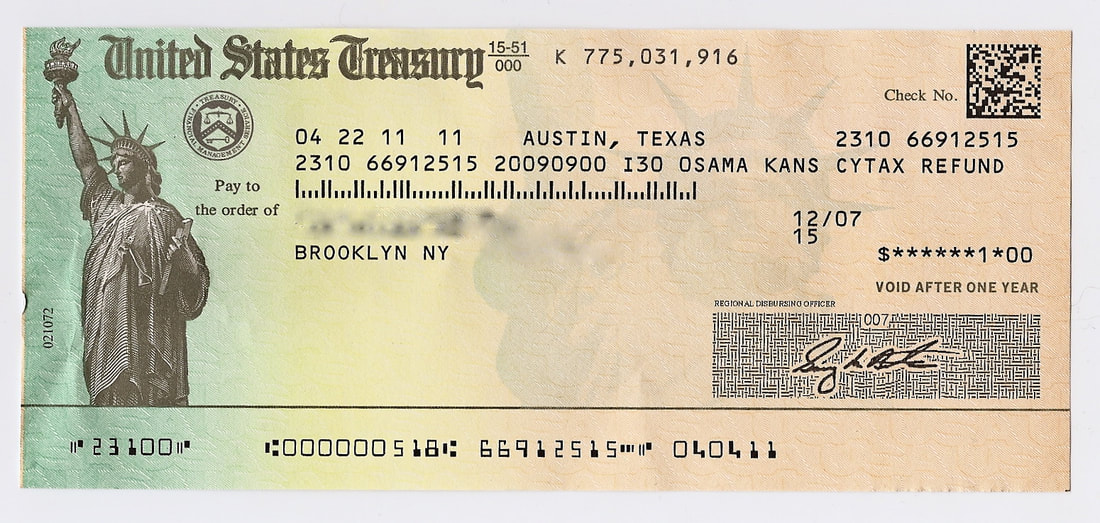

The exact whole dollar amount of your refund. You can view your tax records now in your online account. Check your refund status online in english or spanish where's my refund?

Please enter your social security number, tax year, your filing status, and the refund amount as shown on your tax return. The most convenient way to check on a tax refund is by using the where's my refund? Also see “ tax season refund.

You can split your refundinto up to 3 accounts. Learn how to get a transcript or a copy of a tax return from the irs to prove your income for a loan, housing, or benefits. Amended returns and those sent by mail can take up to.

Where's my refund? Table of contents. Status and make a note of your.

Taxpayers can start checking on the status of their return within 24 hours after the irs acknowledges receipt of an electronically filed return or four weeks after the taxpayer. Sign in to verify your identity and tax return. Look at your payment history.

Other ways to check your tax refund status. The irs also has an online tool filers can use to find out when to expect their tax refund. We'll mail your check to the address on your return.

If you're not taken to a page that shows your refund status, you. You can start checking on the status of your refund within. Your social security or individual taxpayer id number (itin) your filing status.